Market Leader in Private Credit

KBRA brings a unique lens to the evolving Private Credit landscape, delivering sharp insights through deep research, dynamic webinars, and rigorous rating analysis.

Q4 2025 Middle Market Borrower Surveillance Compendium: Stability at the Median, Stress at the Margins

KBRA’s Q4 2025 Middle Market Borrower Surveillance Compendium highlights mixed credit trends across 3,649 assessments completed in 2025, with overall portfolio stability despite pressure in certain subsectors, covering 2,416 global sponsored borrowers representing over $1 trillion in direct lending debt and featuring updated Q4 activity data and new long term performance insights.

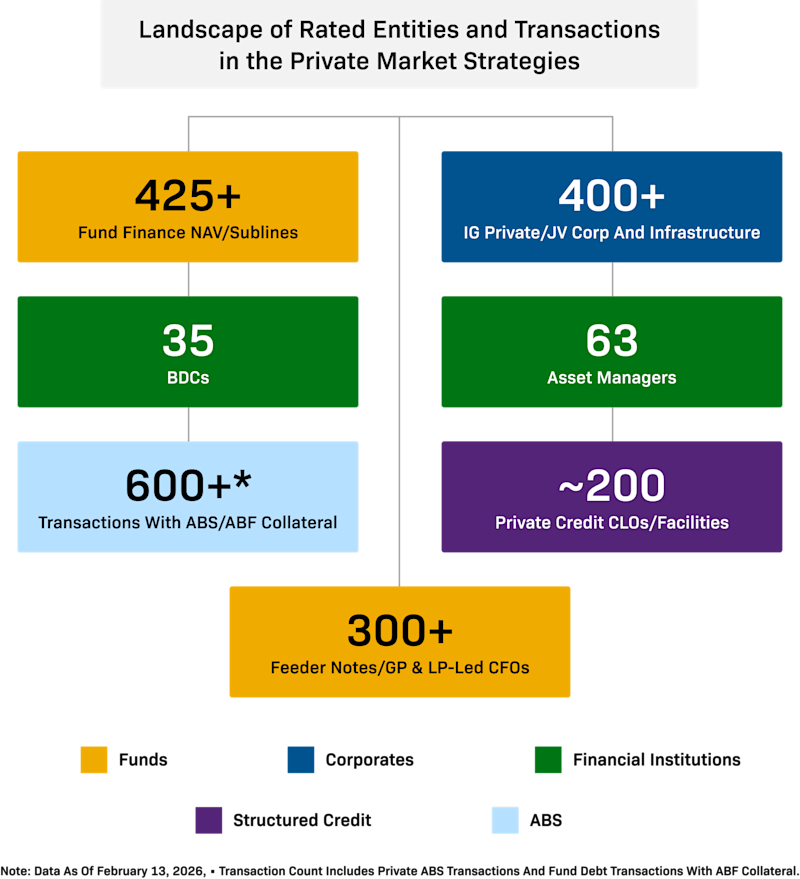

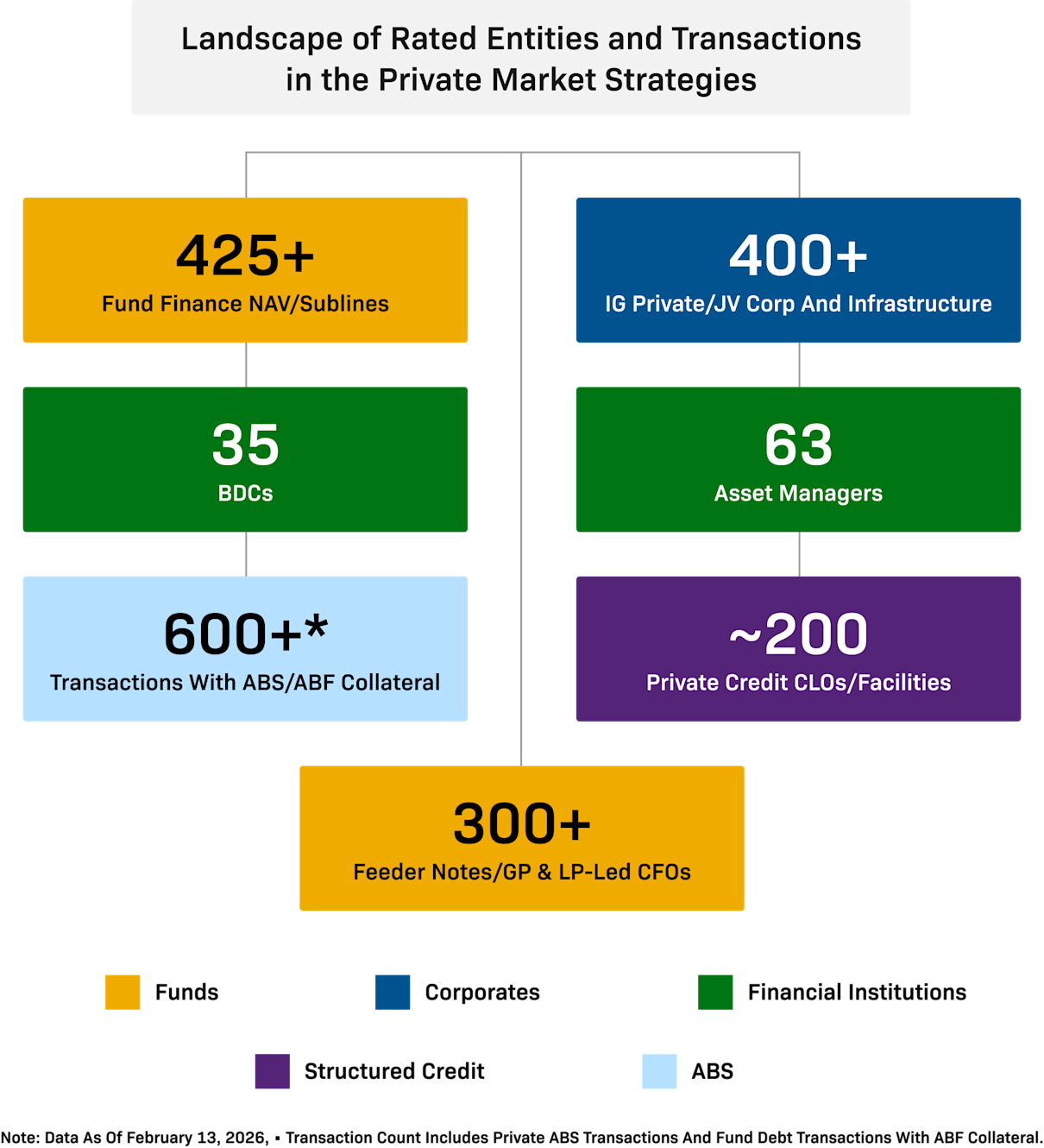

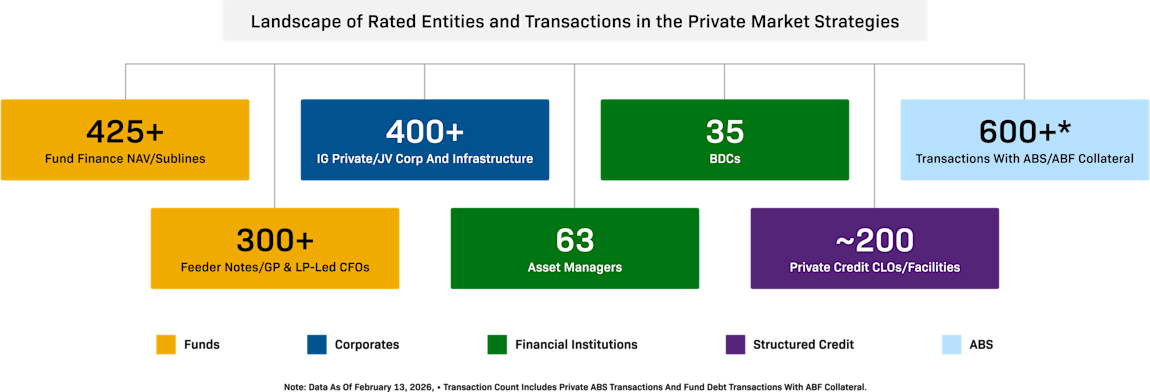

Expanding Use of Ratings in Private Credit

KBRA has over 1,000 ratings of transactions and issuers within the private capital universe and has worked with over 100 sponsors.

Performed 3,500+ underlying credit assessments on middle market sponsor-backed companies in 2025

Latest Private Credit Research

Q4 2025 Middle Market Borrower Surveillance Compendium: Stability at the Median, Stress at the Margins

KBRA’s Q4 2025 Middle Market Borrower Surveillance Compendium highlights mixed credit trends across 3,649 assessments completed in 2025, with overall portfolio stability despite pressure in certain subsectors, covering 2,416 global sponsored borrowers representing over $1 trillion in direct lending debt and featuring updated Q4 activity data and new long term performance insights.

KBRA Comments on Blue Owl Capital Corporation II's Asset Sales

KBRA views OBDC II’s announced asset sales as supportive of deleveraging and enhanced balance sheet flexibility, aligning with the company’s shareholder liquidity objectives. The transactions are part of a broader platform initiative and are expected to settle in the near term.

Evaluating PIK Optionality in CLOs

KBRA examines the use of paid-in-kind (PIK) interest in corporate portfolio finance.

Lessons From 2025's At-Risk Cohort

KBRA releases updated research on the 5% of 1,903 levered middle-market borrowers assessed in 2024 that were identified as being at an elevated risk of future payment default.

Framing AI and Software Risk

KBRA presents data and observations to help frame the potential risks artificial intelligence (AI) may pose to the direct lending landscape, in the context of recent market volatility.

From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

KBRA research explores evolving partnerships between life and annuity insurers and asset managers, noting broader deal structures that may support long-term sector stability.

Webinars & Podcasts

Register for our Private Credit Webinar: Asset Managers in Focus

Join KBRA's sector experts on Tuesday, March 3 at 11:00 AM EST, for our Private Credit: Asset Managers in Focus webinar. During the discussion, our analysts will examine key performance trends across asset managers in 2025, while also sharing perspectives and KBRA’s 2026 sector outlook.

Absolute Credit Series Rated Funds & CFOs 2025 Update

KBRA Chief Rating Officer Bill Cox discusses growth in rated funds and CFO markets and how KBRA evaluates risk as private credit demand evolves.

3 Things in Credit: Spread Wideners, Private Credit Color, 2026 Risks

Listen on: Apple Podcasts YouTube Music Spotify

3 Things: Coming Tailwinds, Fed Drama, and Private Credit Data Update

Listen on: Apple Podcasts YouTube Music Spotify