KBRA Year-End Review 2025

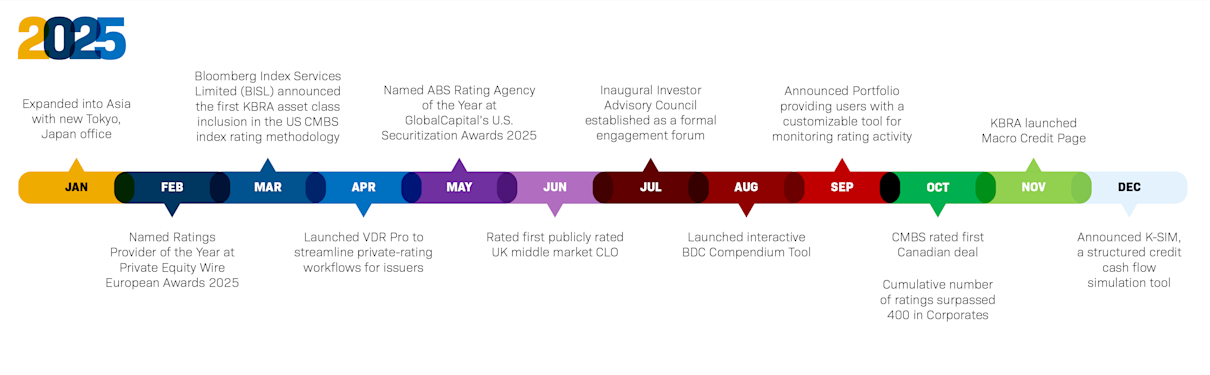

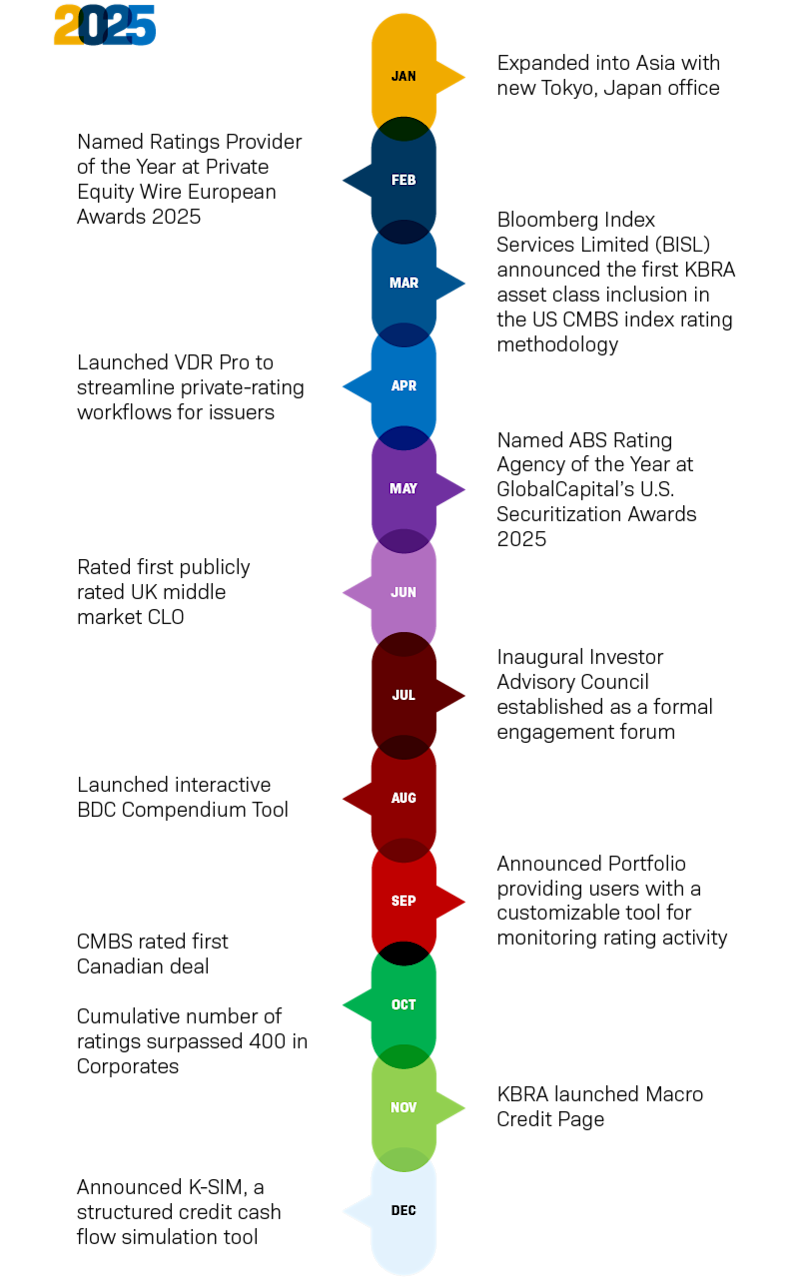

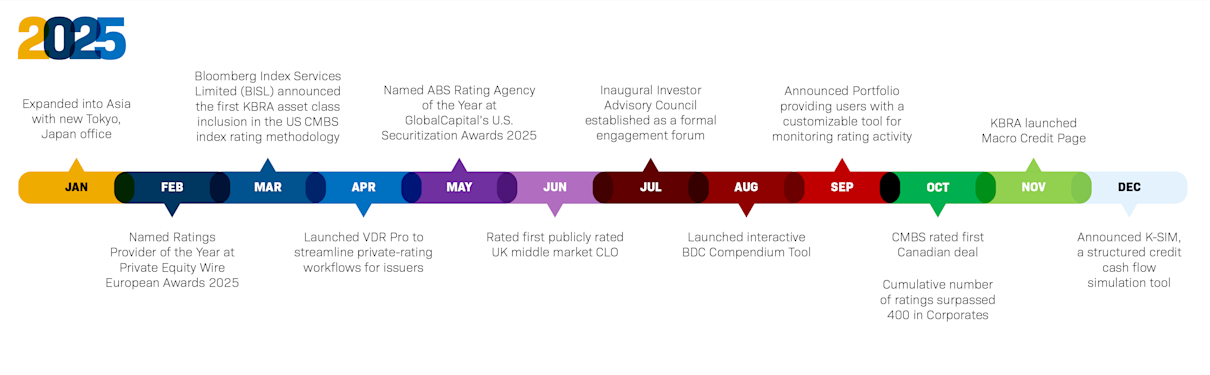

KBRA extends our gratitude for your ongoing support as we move into 2026. Our commitment to deliver unmatched service and trusted ratings and research remains steadfast. Scroll below to view our top milestones throughout the past year.

$497 BN

Rated Issuance

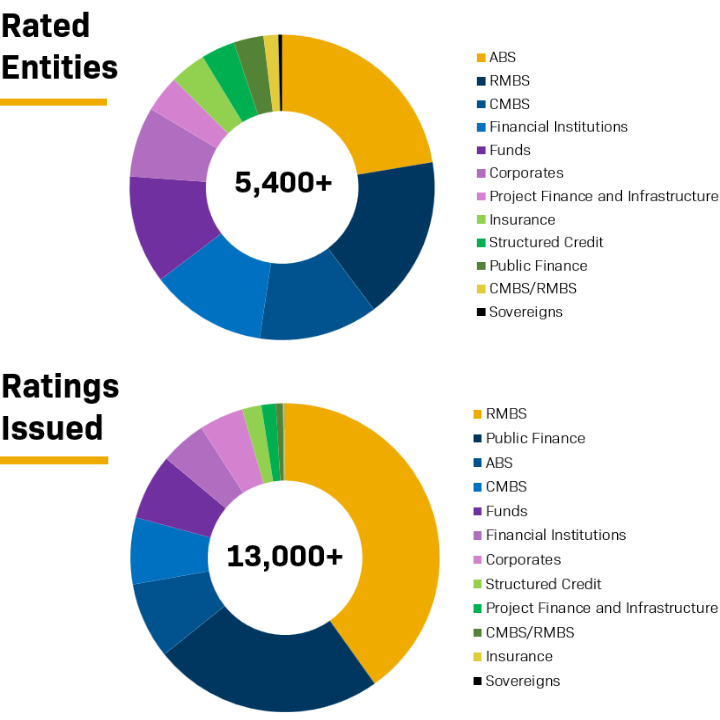

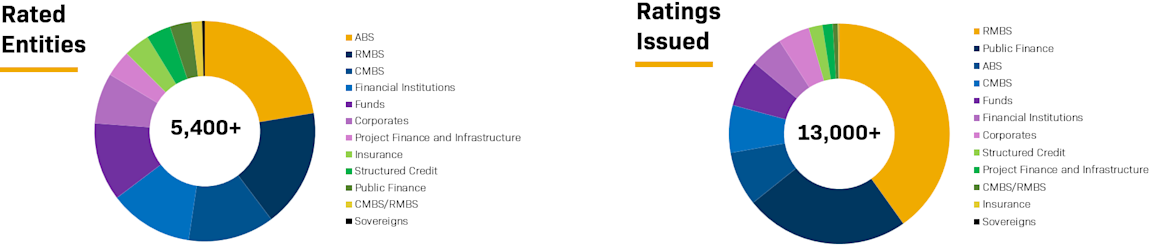

5,400

Rated Entities

13,000

Ratings Issued

KBRA Named ABS Rating Agency of the Year at GlobalCapital’s U.S. Securitization Awards 2025

KBRA was named ABS Rating Agency of the Year by GlobalCapital, recognizing its leadership and influence in the U.S. asset-backed securities market. The award highlights KBRA’s transparent and practical approach to credit ratings, its expertise across both traditional and esoteric ABS asset classes, and its collaborative, cross-disciplinary analytical model. KBRA was also recognized for providing timely, context-rich research and for consistently engaging with investors and issuers as the ABS market continues to evolve.

KBRA Named Ratings Provider of the Year at Private Equity Wire European Awards 2025

KBRA received Ratings Provider of the Year recognition at the Private Equity Wire European Awards, reflecting its strong reputation across Europe’s private credit and private equity markets. The firm was acknowledged for delivering rigorous, data-driven analysis and for maintaining high standards of transparency and accessibility as the market becomes more complex. KBRA’s extensive coverage across private credit portfolios, fund finance, and private asset managers further underscores its role as a trusted ratings provider.

Three KBRA-Rated Deals Win Bond Buyer Deal of the Year 2025 Awards

Congratulations to the 3 KBRA-rated winners who are the top 10 finalists for Deal of the Year 2025! They were recognized for their outstanding achievements in Municipal Finance in their regions and categories.

DFW International Airport, Cities of Dallas and Fort Worth – Southwest Region Winner

Georgia SR 400 Express Lanes Project – Public Private Partnership Financing Win

State of Wisconsin – Innovative Financing Award Winner

Top Read HTML Reports

Private Credit: 2025 Outlook

KBRA sees a mixed outlook for private credit in 2025, with improved debt serviceability, renewed M&A activity, and regulatory tailwinds offset by higher-for-longer rates and slowing revenue growth for some borrowers. While many companies have de-levered, KBRA expects stress among weaker obligors, driving a projected 3% default rate by count. Longer term, growth opportunities remain in investment-grade debt and specialty finance despite rising competition from banks.

Private Credit: CFO Growth and Performance

KBRA’s research examines the structure and credit protections of collateralized fund obligations (CFOs), which are backed by diversified pools of private capital assets and issued through multi-tranche special-purpose vehicles. While CFOs have existed for decades, issuance has accelerated, with KBRA rating 152 tranches across 67 CFOs totaling about $37.7 billion from 2018 to 2024. The report also reviews issuance trends, structural features, and rating performance since inception.

SFVegas 2025 Conference: Day 1 Recap

Structured finance professionals gathered in large numbers at a major industry conference in Las Vegas, with strong attendance reflecting broad market engagement. The event featured high-level discussions on the macro environment alongside sector-focused panels covering key segments of the structured finance market.

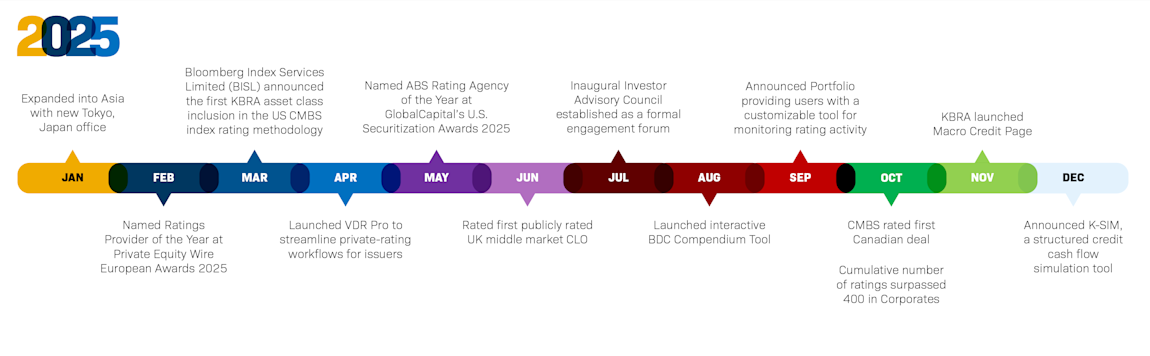

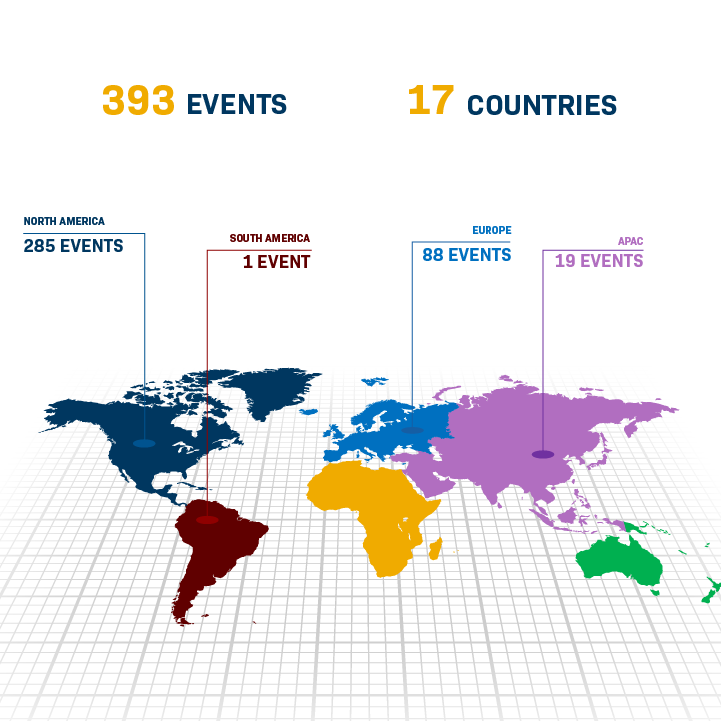

Events Coverage

KBRA maintained a strong and consistent presence across industry gatherings throughout 2025, engaging audiences across a wide range of countries and markets. Our analysts were frequent voices on conference stages, sharing insights and perspectives that reinforced our leadership position. We also hosted numerous client-focused sessions while coordinating a steady flow of meetings at key conferences.

40

Hosted Events

157

Speaking Engagements

165

Attended Programs

890

Conference Meetings

KBRA Podcasts

3 Things in Credit: Home Depot’s Warning, Private Credit Growth, AI Bubble and Credit

Van Hesser, Chief Markets Strategist, highlights three key themes shaping the current market landscape. Home Depot’s warning underscores mounting pressure on consumer durability, while the continued growth of private credit reinforces the importance of closely tracking leveraged finance activity. He also provides a measured perspective on the AI bubble and its implications for credit amid intense market focus.

Listen on: Apple Podcasts YouTube Music Spotify

Credit Compass: A Great Migration

KBRA’s European Macro Strategist Gordon Kerr concludes Conversations in European Credit and highlights the launch of his new KBRA podcast, Credit Compass: Navigating European Credit Markets. The new podcast will serve as a guide for navigating the complexities of European credit and capital markets from a broader macro perspective. It will offer valuable insights and analysis to help investors stay informed and ahead of market trends.

Listen on: Apple Podcasts Spotify

Oil’s Diminishing Role in Euro Area Inflation and Impact on European Corporate and Sovereign Credit Risk

In this episode John Sage, Senior Director and Head of Private Credit Research here at KBRA will be joined by two colleagues — Ken Egan from the Sovereign team and Karim Nassif from the Corporate, Infrastructure and Project Finance team. They will be diving into the topic of how euro area inflation has become less correlated with oil price swings. We’ll unpack why that link has weakened — from reduced oil intensity and greater supply diversification, to stronger policy buffers. We’ll also explore what all this means for the credit outlook of European energy companies.

Listen on: Apple Podcasts YouTube Music Spotify

KBRA Community Impact

In 2025, our Employee Experiences initiative continues to reflect who we are as a firm, bringing colleagues together through meaningful, interactive team building activities and events. Community engagement and service are central to KBRA’s culture, and giving back remains a responsibility we take seriously. We are proud to support organizations that make a tangible difference in the communities where we live and work, including:

Dublin Simon Community

Toys for Tots

Women for Women International (WFF 5K)

Covenant House

Hurwitz Breast Cancer Fund (Pink Ribbon 5K)

NY Food Bank

City Parks Foundation

2026 Sector Outlooks

Don’t miss our sector outlooks for 2026, offering a clear view of the trends, risks, and growth drivers shaping the year ahead. These forward-looking insights distill the key forces that will influence credit performance, investment strategies, and competitive dynamics, helping you stay ahead in a rapidly evolving market.