KBRA Japan

A global credit rating agency delivering transparent ratings and insightful research, now serving the Asia-Pacific market from our new Tokyo.

Private Credit: NAVigating the PE Landscape—NAV Loans Still Perform

Net asset value (NAV) lending has continued to play an important role in supporting the liquidity needs of the private equity (PE) industry amid higher-for-longer interest rates and a challenging PE exit environment over recent years.

650+

Employees

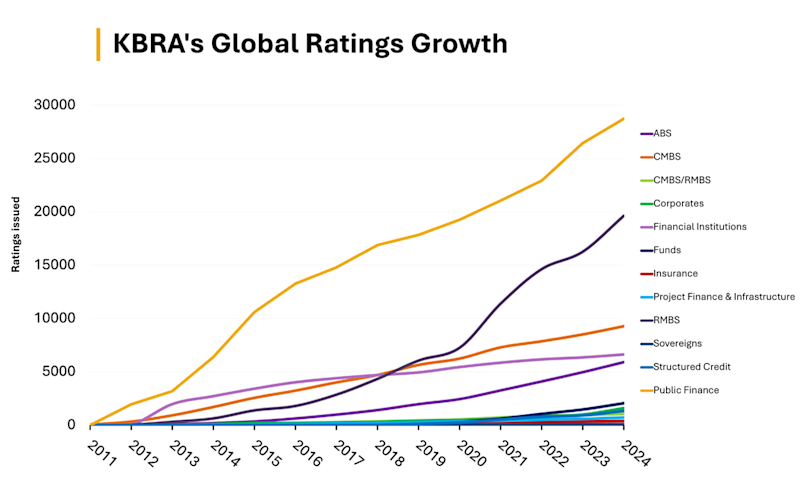

90,400+

Ratings Issued

$4.38 Tn

Rated Issuance

7

Offices Globally

Trusted Analysis. Transparent Surveillance.

Founded in 2010, KBRA has worked to restore trust in credit ratings by setting new standards for assessing risk and delivering clear, credible insights. Our presence in the United States, United Kingdom and Europe has provided global investors with an independent alternative backed by rigorous research and sector expertise.

With our entry into Japan, we look forward to expanding our APAC presence offering market participants the same level of depth, transparency and accessibility. KBRA will provide the investment community with the trusted tools and analysis needed to make informed decisions in a rapidly evolving financial landscape.

Analysis & Coverage Areas

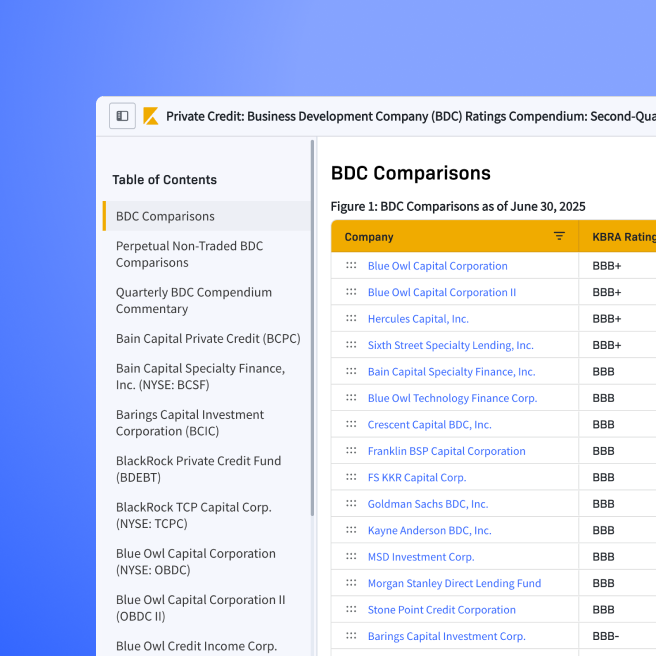

Private Credit

Our in-depth credit analysis and high-quality research reports help facilitate private credit transactions and are viewed as best-in-class by market participants. KBRA continues to be at the forefront of the private credit market globally with expertise across key sectors.

Funds

KBRA's Funds Sector focuses on providing independent credit ratings, risk assessments, and research for investment funds, asset managers, and related financial products. This sector serves institutional investors and fund issuers by delivering transparency and insight into fund creditworthiness and performance.

Structured Finance

KBRA’s Structured Finance sectors provide independent credit ratings and risk analysis for securitized products, including esoteric and consumer asset-backed securities (ABS), commercial mortgage-backed securities (CMBS), residential mortgage-backed securities (RMBS), and structured credit and collateralized loan obligations (CLOs). KBRA delivers transparent, data-driven insights to help investors assess risk and issuers optimize market access.

Structured Credit

Our Structured Credit team evaluates the relative ability of an entity or an obligation to meet financial commitments. KBRA provides broad coverage across segments, including CLO (middle market/PC, BSL, project finance), warehouse and credit facilities (delayed-draw CLOs and warehouse structures, bilateral revolving credit facilities), recurring revenue loans, and CDOs/CBOs (CDOs of trust-preferred securities (TruPS), collateralized bond obligations, securitizations of NAV loans).

Corporate, Financial & Government

KBRA Named Ratings Provider of the Year

Private Equity Wire European Awards 2025

KBRA was named winner in the Ratings Provider of the Year category at the Private Equity Wire European Awards 2025 ceremony held on February 13 in London. The awards recognise excellence among private equity fund managers and service providers in Europe across a range of categories.

Our Services

For Investors

Credit Ratings & Research - Independent ratings and in-depth market insights across structured finance, corporates, financial institutions, private credit, and insurance.

Risk & Market Insights - Comprehensive research reports, market commentary, and sector trends to aid investment decisions.

For Issuers

Credit Ratings for Structured Finance - Assessments for esoteric (data centers) and consumer asset-backed securities (ABS), commercial mortgage-backed securities (CMBS), residential mortgage-backed securities (RMBS), and structured credit and collateralized loan obligations (CLOs).

Corporate & Financial Institution Ratings - Evaluations of creditworthiness for banks, insurance companies, asset managers, and corporations.

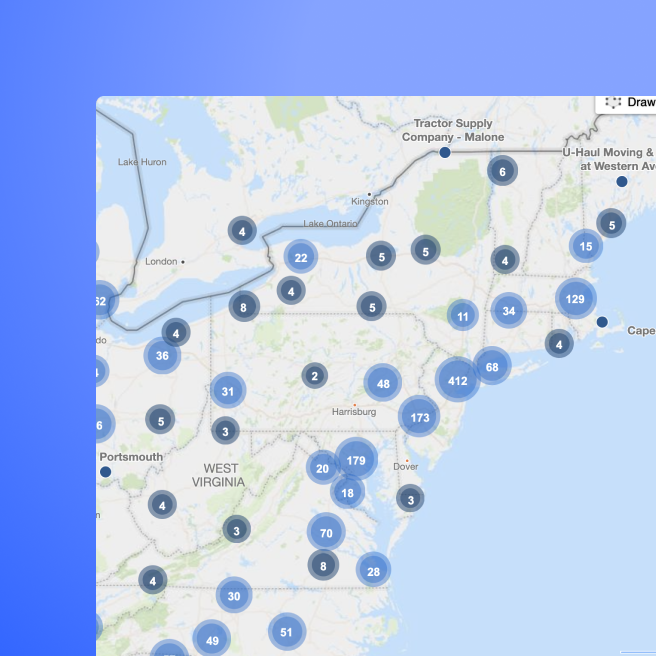

Project Finance - Ratings for transactions across 17 countries in power and energy, communication and technology infrastructure, renewables, leisure, social infrastructure, transportation, and shipping.

Our Offices

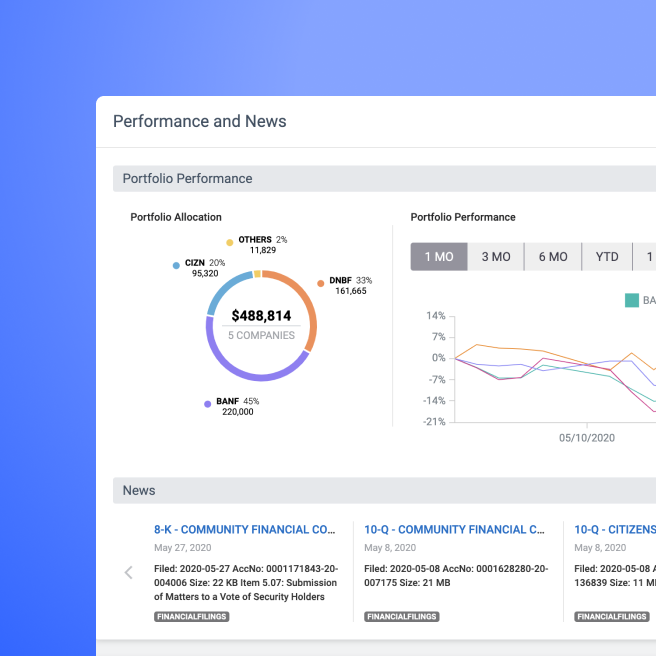

KBRA Analytics

A New Generation of Data-Centric Applications

KBRA Analytics is our premier product platform for high quality data and advanced analytics. Our seasoned teams of industry specialists across each product provide unparalleled insight creating a foundation for users of deeper analysis and rapid discovery.

KBRA Direct Lending Deals (DLD)

Exclusive news and analysis for originators and investors in private credit and direct lending.

KBRA Premium

Subscription-level access to KBRA’s trusted ratings, in-depth research, and powerful analytical tools.

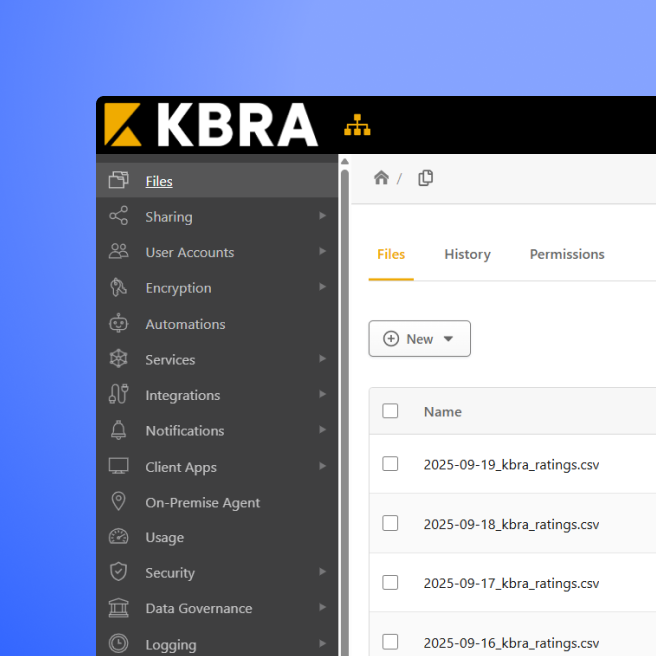

KBRA Ratings Feed

Seamless delivery of KBRA rated securities via a direct feed.

KBRA Credit Profile (KCP)

The standard in monthly CMBS Surveillance.

KBRA Financial Intelligence (KFI)

Data and analytics for banks and credit unions.