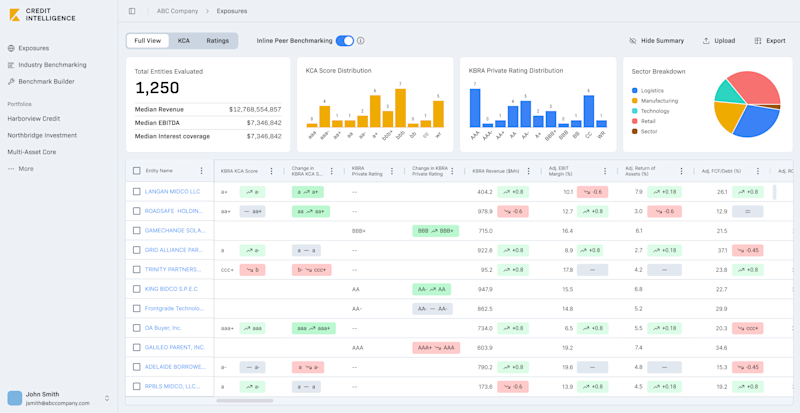

Benchmark Your Private Credit Borrowers Against the Market

Compare leverage, coverage, and liquidity metrics for your private credit exposures against middle-market borrowers—segmented by size and sector—using audited, normalized KBRA data. Built on borrower-level financials that are otherwise private and not available through public filings or sponsor marketing materials.

Credit Intelligence creates transparency in the private credit market.

$1.3T+

Private credit exposure represented

4,500+

Middle-Market Private Credit Borrowers

135,000+

Normalized Corporate Financial Data Points

Built on Real Private Credit Borrower Data.

Credit Intelligence is powered by anonymized, audited financial data from middle-market private credit borrowers.

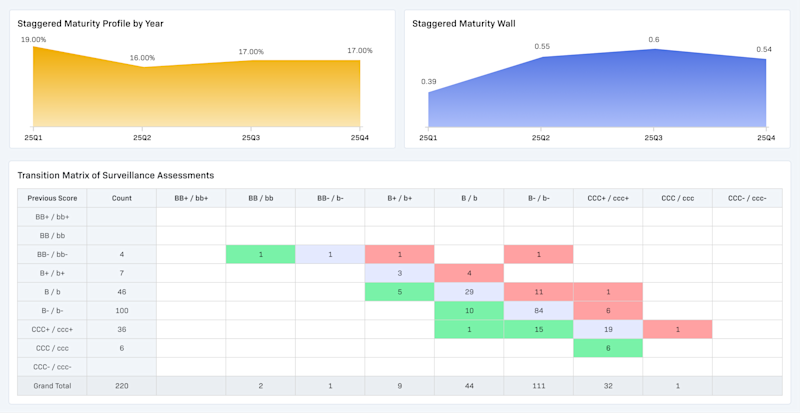

KBRA normalizes financials across sponsors and structures to create directly comparable leverage, coverage, and liquidity metrics—enabling true market benchmarking. This ensures financial ratios are calculated consistently, eliminating distortions that arise from sponsor-specific definitions or reporting conventions.

How it Works

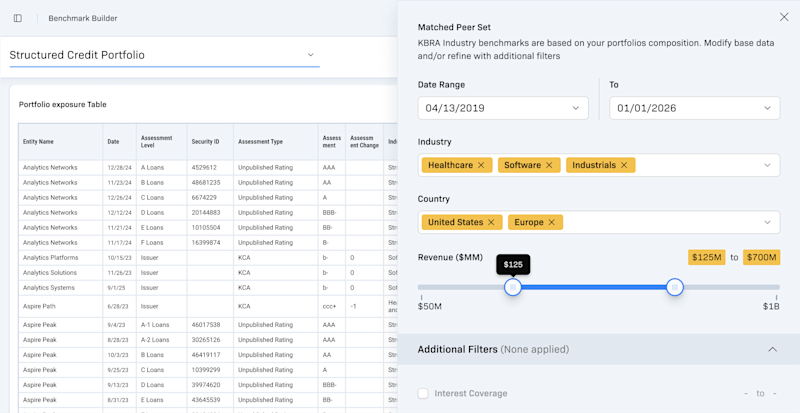

Benchmark Borrowers by Size and Sector

Understand whether your borrowers are positioned above or below market medians within their true peer set.

Analyze Portfolio-Level Credit Positioning

Group loans into portfolios by fund, strategy, or mandate. Assess how your portfolio compares to the broader private credit market.

Generate KBRA-Branded Reporting

Investor-ready reports aligned with KBRA methodology, supporting transparency, governance, audits, and fundraising.

Key Features

Dynamic Benchmarking

Create peer groups that mirror your portfolio by size, sector, and revenue profile.

Portfolio Aggregation

Group exposures into portfolios by fund or strategy

Normalized Financial Metrics

Compare borrowers using standardized leverage, coverage, and liquidity calculations applied consistently across the dataset.

Secure Data Integration

Access supporting documentation via KBRA’s Virtual Data Rooms (VDR) to enhance oversight and governance.

Built on KBRA Credibility

Credit Intelligence is grounded in KBRA’s independent private credit methodologies and borrower-level fundamental analysis.

It brings institutional rigor and normalization discipline to otherwise opaque private credit markets.

Contact Us

Fill out the form and a Credit Intelligence specialist will reach out to you.