KBRA DLD: Breaking News & Research

Insight into direct lending strategies, pricing shifts, and default risk across US & Europe.

Ares finances Kinderhook-backed asset into continuation vehicle

Ares Management led a group of lenders to finance the closing of a single-asset continuation vehicle for an industrial portfolio company of Kinderhook Industries. The transaction secured more than $400 million in new equity to support organic growth and M&A strategies.

11,000+

Filter & Export deals from database

2,000+

Private equity sponsors tracked

across U.S. and Europe

$1T+

U.S. private deal volume aggregated

from direct submissions

200+

At-risk borrowers flagged in

Default Radar monitoring

Precision data for direct lending strategies in the U.S. and Europe.

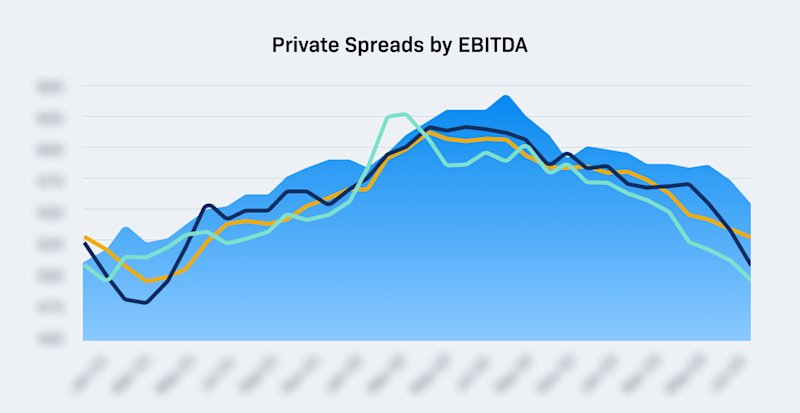

DLD’s data cuts are aligned with distinct direct lending strategies across the U.S. and Europe.

Our research defines and analyzes the lower and core middle markets, as well as large-cap loans. New analysis is introduced alongside evolving trends and market feedback. U.S. trendlines are delivered monthly—giving you a more accelerated view of the market than providers relying on less frequent reporting.

Built for Direct Lending Professionals

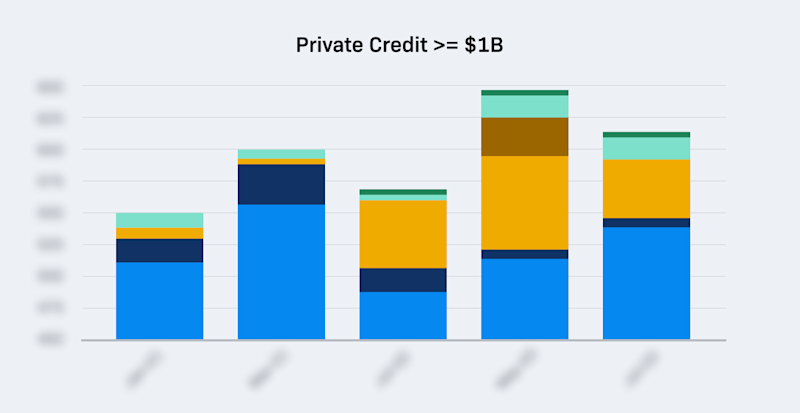

Jumbo Loan Stats

Large-scale private loans compete most directly with liquid credit. DLD enables cross-market visibility to track shifting terms and relative value.

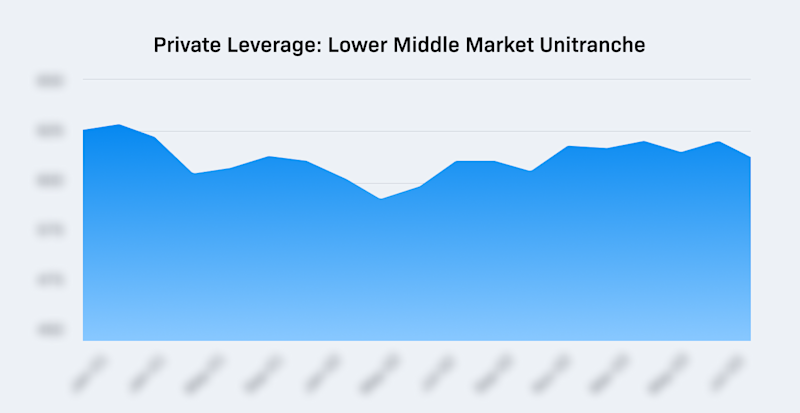

Lower Middle Market

Monthly insight into pricing, leverage, and deal terms across the most opaque segment of direct lending.

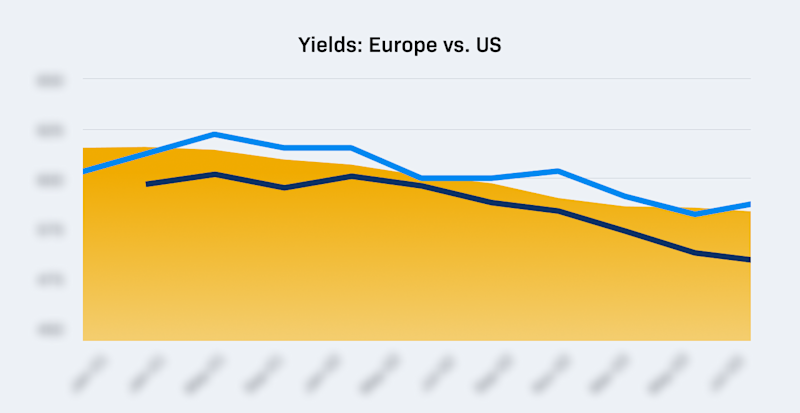

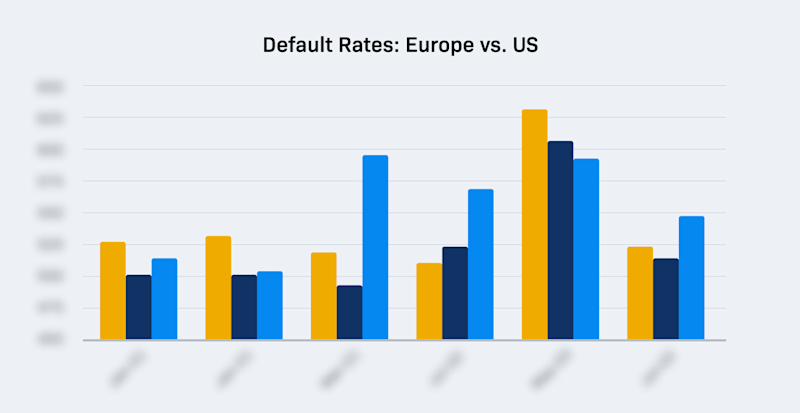

Europe versus US

Quarterly European research from DLD provides detailed views on key statistics across euro- and sterling-denominated deals, alongside US market comparisons.

One Platform. Exclusively Direct Lending

Online Deal Database

Unlimited access to searchable platform for US and European deals with exportable results to excel. Filter by lender, sponsor, proceeds and more. Track competitor business, advisory roles and unmandated leads in Europe

News Reporting

Real-time updates and Weekly Wraps offering color from long-standing relationships among senior level leaders. Track trends across large-cap private loans and steals from liquid credit.

Proprietary Research & Trend Reports

Exclusive analysis built from private submissions. Explore Monthly and Quarterly trendlines on spreads, leverage and defaults.

Default Radar

Track 200+ at-risk borrowers via Red/Orange tiers. Includes fair value trends, sector breakdowns, and implied recoveries.

Rankings & Market Share

KBRA DLD’s monthly lender and quarterly advisor lists are drawn from submissions and news reporting, capturing key firms in both the U.S. and European markets.

Indices

Proprietary Indices for Direct Lending, Syndicated Loans and High Yield.

Direct Lending API

KBRA’s Direct Lending API provides programmatic access to an extensive direct lending deal database.

Default Coverage

Users receive the monthly US default report and a quarterly European edition, along with weekly updates covering direct lending plus the larger institutional loan and high yield bond markets. Highlights for both regions include:

Default Radar highlighting specific borrowers and sector breakdowns from our Red and Orange Tiers

Year-to-date rates and forecasts

Proprietary data- and trend-driven commentary

Implied recoveries tracked via post-default price charts and commentary

Stats from our KBRA DLD Index comprising roughly ~3,000 direct lending borrowers in the US and Europe

Serving the Entire Direct Lending Market

DLD supports leading institutions across private credit

Lenders

Benchmark deal flow, monitor peer activity, identify mandate opportunities, and track shifts in structure and pricing with clarity and precision

Sponsors

Access market color and analysis on key deal terms, lender activity, and competitive dynamics across private credit and liquid credit markets.

Advisors

Leverage deep insight into sponsor–lender relationships and cross-industry deal activity to inform positioning and execution.

Law Firms

Gain clear insight into leveraged finance structuring trends, sponsor mandates, and law firm activity across middle market and large-cap segments.

Clarity Where Others Fall Short

KBRA DLD offers a singular focus on direct lending—no cross-asset noise or irrelevant data. We stand apart from broader market coverage, earning recognition across the private credit industry as a trusted source of direct lending intelligence.

Deeper Intelligence

DLD collects data directly from market participants, reflecting deep industry trust.

Faster Access

DLD continuously collects market data, making it the only source to deliver monthly direct lending metrics.

Comprehensive Coverage

News and analysis spanning the entire direct lending spectrum

Credibility at Scale

Data trusted by the biggest names in direct lending

Meet the Team

Contact Us

Get started with a Trial. Request access to the platform, including news, reports, and rankings.