Premium

Trusted Ratings. Actionable Research.

With a KBRA Premium subscription, you gain full access to KBRA’s market-leading ratings, deep research, and industry-leading analytics. Built for market professionals who require clarity, context, and confidence in every decision.

4,000+

Rated Deals

9,500+

Published Ratings & Research Reports

$4.4T+

Rated Issuance

Premium Subscriptions

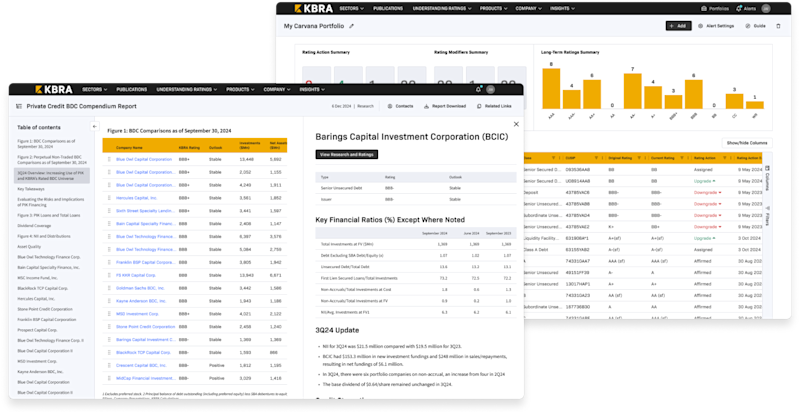

Private Credit Subscription

Private credit is among the fastest-growing asset classes—serving middle market borrowers, asset managers, credit funds, business development companies (BDC), and financial sponsors.

Asset Managers BDCs Funds Structured Credit

Middle Market Borrower Surveillance: Covering ~2,200 names with sector-level insights and early risk signals

Structured Credit Tools: CLO manager benchmarking, recurring revenue loan screens, and trend watch reports

BDC and Funds Research: Quarterly BDC Compendium and broad research on Fund performance

ABS Subscription

Covering Autos, Data Centers, Music Royalties, WBS, Solar, Consumer Loans and much more, the ABS subscription enables sharper insight into collateral performance and market dynamics.

Consumer ABS Commercial ABS

Historical Ratings Data: Track past ratings actions to contextualize performance

Monthly Indices: Auto, equipment, solar, marketplace loan indices to highlight credit shifts

Powerful Analytics: Deal or shelf benchmarking with the KBRA Comparative Analytic Tool (KCAT) including downloadable datasets

CMBS Subscription

The CMBS subscription equips you with property-level insight, loan surveillance, and securitization context.

Conduit Single-Borrower CRE CLOs

Deal-Level Insights: Pre-sale and surveillance reports combined with historical ratings data

Market Intelligence: Sector Outlooks, property research, default and loss studies

Analytical Tools: KCAT benchmarking, Trend Watch tools, downloadable credit datasets

RMBS Subscription

Covering the full spectrum of mortgage-backed securities, the RMBS subscription helps you assess collateral performance and structural risk.

Prime Non-Prime CRT HELOC/CRT

Comprehensive Coverage: Prime, non-prime, credit risk transfer (CRT), non-QM, HELOC/CES

Monthly Indices: Delinquencies, prepayments, modifications, performance metrics

Advanced Analytics: KCAT with CRT metrics, enhanced data fields, flexible benchmarking

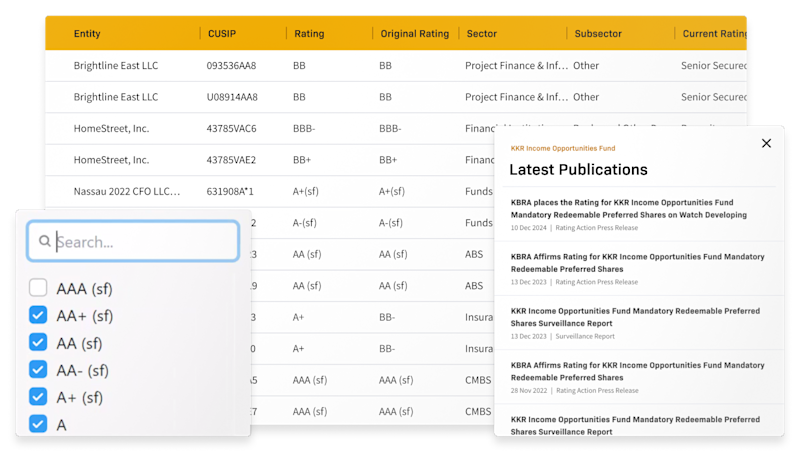

KBRA Portfolios

A centralized, intuitive dashboard for tracking KBRA credit ratings and analytics across your portfolio or sectors of coverage:

Upload your list of securities and issuers in seconds

Configure an Excel-style grid—toggle metrics, view ratings and structural features

Filter, sort, and slice across entity, sectors, or timeframes

Receive real-time notifications on your portfolio

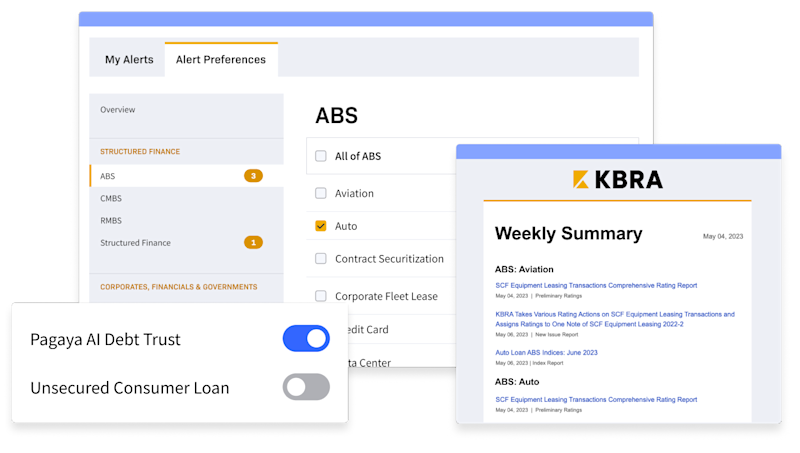

KBRA Alerts

Receive timely updates from your coverage areas so you don’t miss anything:

One-click subscriptions to ratings and research alerts

Custom filters and views across sectors and names

Alerts delivered via email and your notification dashboard

Who We Serve

Analysts

Deepen understanding of KBRA’s applied methodologies and thorough research, assess counterparty and collateral risk, and benchmark deals—strengthening underwriting capabilities, portfolio strategy or risk oversight.

Investors & Portfolio Managers

Evaluate creditworthiness, compare deal structures, and access surveillance data—supporting value assessments, investment decisions, and risk calibration.

Underwriters

Benchmark transactions, examine issuer metrics, and monitor comparables to support comprehensive market analysis.

Specialized Investors and Advisors

For real estate funds, structured finance teams, law firms, and strategy boutiques: dig into property-level insights, benchmark niche securitizations to support client strategies.

Request a Consultation

Ready to explore how KBRA Premium can bolster your credit insights and decisions? Whether you’d like a demo, pricing, or tailored support, our team is here to help.