Ratings Feed: Trusted Credit Ratings to Navigate Complex Markets

Reliable access to issuer and security-level ratings, delivered in flexible, structured formats built for enterprise integration

90K+

Ratings Issued

4.8K+

Rated Entities

$4.4T+

Rated Issuance

Why Firms Choose KBRA Ratings Data

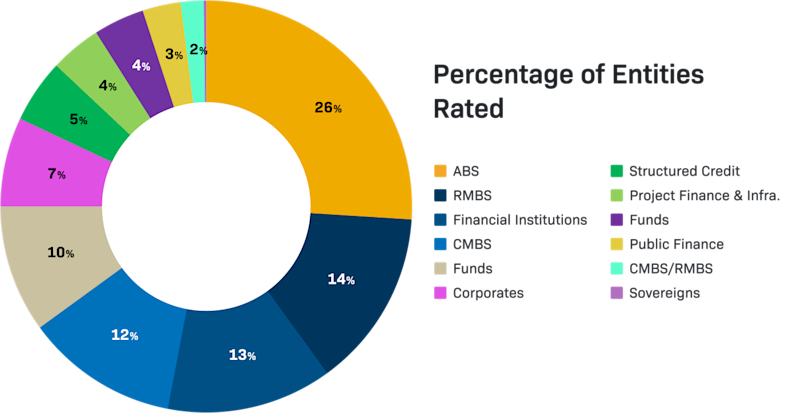

Scale and breadth of ratings coverage with 90,000+ public and private ratings issued covering $4.4 trillion of rated issuance across all sectors.

Market-leading coverage in Structured Finance, Public Finance, and Financial Institutions

Significant KBRA-only and KBRA +1 issuance, delivering unique ratings coverage and additional credit signals exclusively available from KBRA

Transparent and explainable credit opinions, with clearly articulated risk drivers, assumptions, and structural considerations that supporting defensibility across investment, risk management, compliance, and reporting use cases

Trusted by 95% of the top 50 global fixed income investors

What’s Included in the KBRA Ratings Data Feed

Issuer-level and security-level public ratings, including rating actions (assigned, affirmed, upgraded, downgraded, and withdrawn), watch status, and outlooks

Structured, well-defined data fields with market-standard identifiers (e.g., CUSIP, ISIN, and LEI) designed for consistent intake and reconciliation

Daily updates reflecting official published rating actions, supporting timely monitoring and reporting

Audit-ready rating history, enabling defensible use across risk management, compliance, and regulatory reporting workflows

View Ratings Feed Specifications (for Data Managers)

Delivery Options

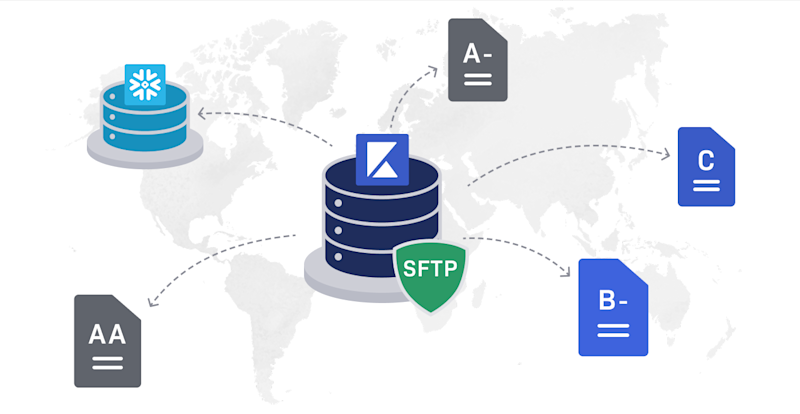

Direct From KBRA

Email | FTP | SFTP

Receive KBRA public ratings data directly from the source, with customizable sector-level feeds and flexible delivery schedules. This option provides the highest level of control over content, timing, and integration into internal systems.

Snowflake

Direct Cloud Delivery via Snowflake Marketplace

Access KBRA ratings data directly within Snowflake, enabling sector-level customization, rapid onboarding, and seamless integration into modern cloud-based data environments.

Third-Party Platforms

Bloomberg | Aladdin | FactSet

Access KBRA public ratings through leading third-party platforms as part of broader market data environments. Ratings are delivered as published, with all covered sectors included.

Purpose-Built for the Teams Powering Modern Credit Markets

Asset Managers and Portfolio Analysts

Incorporate trusted ratings into portfolio systems to assess credit quality, monitor changes across holdings, and support investment decisions, risk calibration, and client reporting.

Risk and Compliance Managers

Use transparent, audit-ready ratings data to support internal risk frameworks, capital calculations, regulatory reporting, investment policy compliance, and defensible oversight of rated exposures.

Client Reporting and Operations Teams

Leverage consistent, up-to-date ratings data to support client disclosures, performance reporting, and internal dashboards, ensuring accuracy and consistency across reporting cycles.

Structured Finance Analysts

Monitor issuer- and security-level ratings and track outlook changes to support surveillance, deal analysis, and portfolio monitoring.

Talk to Our Ratings Data Specialists

Get answers on coverage, delivery options, and how KBRA ratings data fits into your risk, compliance, or reporting workflows.

Contact

For questions about KBRA ratings data or delivery options, you may contact our specialist directly.