Private Credit Premium

KBRA brings a unique lens to the evolving Private Credit landscape, delivering sharp insights through deep research and rigorous rating analysis.

700+

Private Fund & Sponsor Financing Transactions Rated

750+

Private Credit Capital Markets Transactions Rated

4,500+

Underlying Credit Assessments

Rating Publications

KBRA Premium delivers comprehensive coverage across the Private Credit markets including funds, BDCs, asset managers, and structured credit-equipping users with transparent and comprehensive rating reports.

Preliminary/New Issue Reports

Our Preliminary and New Issue reports deliver forward-looking credit analysis that help market participants evaluate new transactions with confidence.

These reports provide in-depth insight into deal structure, collateral quality, and key credit considerations.

Surveillance Reports

Timely reviews to validate rating alignment with performance and evolving conditions.

Historical Ratings

Review affirmations, upgrades, downgrades, and withdrawals to derive performance context.

Compendiums

Quarterly deep-dive publications that bring clarity to evolving private credit markets—delivering borrower-level surveillance, BDC performance comparisons, and early signals of emerging risks and opportunities.

Private Credit MM Borrower Surveillance Compendium

A comprehensive quarterly review of credit trends across nearly ~2,200 middle market borrowers, offering sector-level insights and early warnings on emerging risks in the direct lending landscape.

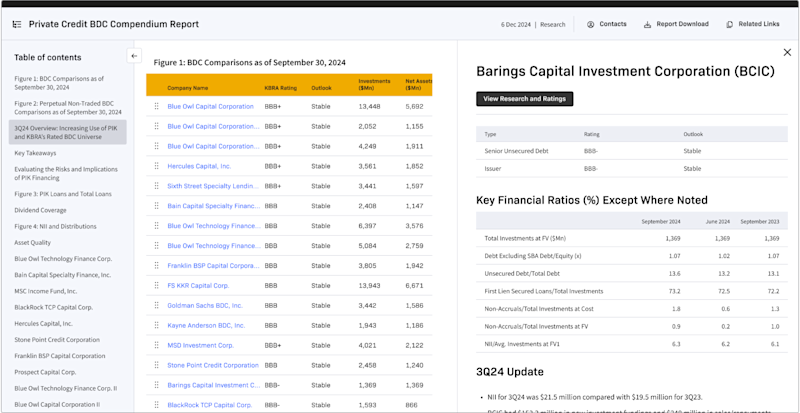

Business Development Company (BDC) Ratings Compendium

This quarterly compendium offers KBRA’s latest insights on BDC performance, spotlighting liability management strategies, credit stability, and market trends amid a competitive and capital-rich private credit environment.

Coverage

Across direct lending, BDCs, structured credit, and asset managers, our Private Credit package gives you unparallelled transparency and analytical rigor.

Middle Market Borrowers

Surveillance of ~2,200 companies with sector-level insights

BDCs (Business Development Companies)

Ratings, surveillance, and quarterly BDC Compendium

Structured Credit

CLOs, recurring revenue loan securitizations, repacks, and other structured private credit vehicles

Collateralized Bond Obligation

Collateralized Debt Obligation

Collateralized Loan Obligation

Credit Facility/Warehouse

Recurring Revenue Loan Securitization

Repack

Funds

Collateralized fund interests, fund finance (40 Act, NAV, sublines, other), and feeder fund rated notes

Collateralized Fund Interests

Fund (kf)

Fund Finance - 40 Act Fund

Fund Finance - NAV

Fund Finance - Other

Fund Finance - Sub Lines

Fund Investment - Feeder Fund Rated Notes

Fund Investment - GP CFO

Sponsor Balance Sheet

Asset Managers

Ratings and research at the manager level

BDC Compendium

KBRA leads the market with over 30 KBRA-rated BDCs. The new and improved Business Development Company (BDC) Compendium Tool offers interactive features to make comparing our rated BDCs with ease.

Built for busy professionals, this streamlined tool lets you:

Compare BDC data to make informed decisions

Sort and filter metrics across 30+ KBRA-rated BDCs

Export and analyze consolidated data and spot trends in the market

Market Insights & Research

As private credit continues to grow in importance across the financial landscape, having access to high-quality, data-driven research is essential for understanding evolving market dynamics. KBRA’s Private Credit Research provides clarity, offering actionable insights into middle market lending trends, portfolio composition, credit performance, and investor sentiment.

Annual Sector Outlooks

Industry outlook, year in review, performance themes, trends, and forecasts generally published annually or semiannually.

Conference Recaps

KBRA attends and participates in numerous industry conferences and events. Our recaps of these events are an industry must-read.

Rating Stability & Transition Studies

Analyzes the consistency and evolution of KBRA’s credit ratings over time. These studies track upgrades, downgrades, affirmations, and withdrawals across sectors—helping market participants assess rating performance, transition trends, and long-term credit stability.

Private Credit Research

Research encompasses insights and analysis generally tied to a specific sector or sectors, including standalone or recurring research, conference recaps, and more.

Quarterly Recurring Revenue Loan Metrics

A semiannual publication that reports realized losses and KBRA’s future loss expectations on our rated transactions.

CLO Manager Comparison

Comparative insights into evolving European CLO manager styles, enabling investors to identify strategies that align with their goals.

Structured Credit Trend Watch

A snapshot of the structured credit market, highlighting issuance trends, spread movements, key developments, and KBRA’s rating activity.

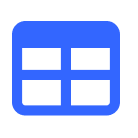

KBRA Portfolios

A centralized, intuitive dashboard for tracking KBRA credit ratings and analytics across your portfolio or sectors of coverage:

Upload your list of securities and issuers in seconds

Configure an Excel-style grid—toggle metrics, view ratings and structural features

Filter, sort, and slice across entity, sectors, or timeframes

Receive real-time notifications on your portfolio

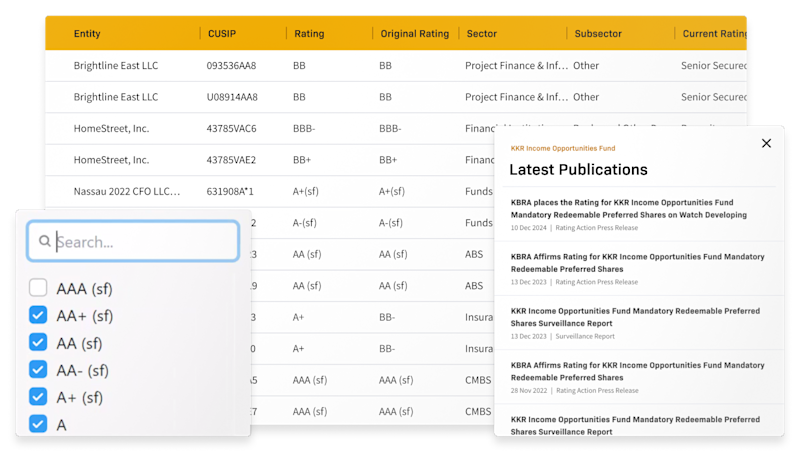

KBRA Alerts

Receive timely updates from your coverage areas so you don’t miss anything:

One-click subscriptions to ratings and research alerts

Custom filters and views across sectors and names

Alerts delivered via email and your notification dashboard

Request a Consultation (Private Credit)

Ready to explore how KBRA Premium can bolster your credit insights and decisions? Whether you’d like a demo, pricing, or tailored support, our team is here to help.