CMBS Premium

KBRA Premium’s CMBS package delivers deep insights into property performance, loan trends, and securitization structures.

13,400

Ratings Issued

1000+

Deals Rated

1st Place

Agency CMBS Ranking

Rating Publications

Pre-Sale/New Issue Reports

Our Pre-Sale and New Issue reports deliver forward-looking credit analysis that help market participants evaluate new transactions with confidence.

These reports provide in-depth insight into deal structure, collateral quality, and key credit considerations.

Surveillance Reports

Timely reviews to validate rating alignment with performance and evolving conditions.

Historical Ratings

Review affirmations, upgrades, downgrades, and withdrawals to derive performance context.

CMBS Sector Coverage

Critical financing across the commercial real estate (CRE) landscape, from conduit pools to single-asset, single-borrower (SASB) and CRE collateralized loan obligations (CLO).

CMBS Subsectors

Agency

Conduit

CRE CLO

C-PACE

Single Borrower

Large Loan

NPL

Re-Securitization

Seasoned

Small Balance CMBS

Single-Family Rental

Small Balance CMBS/RMBS

Trending Topics

Stay ahead in the dynamic CMBS landscape with our comprehensive research on trending topics.

Refinance

Appraisals

ARA

Servicer Advance

Workout Fees

Freddie Mac

LIBOR Transition

Property Sectors

KBRA produces market-leading research across various property sectors, analyzing key secular shifts and their impact on property types and broader industry performance trends.

Properties Covered

Office

Industrial

Lodging

Retail

Multifamily

Single-Family Rental

Data Centers

Self-Storage

Market Insights & Research

KBRA produces a number of ongoing CRE reports on a periodic basis including Trend Watch, Loan Performance, Conduit Loss Compendium, and our annual Sector Outlook.

Annual Sector Outlooks

Industry outlook, year in review, performance themes, trends, and forecasts generally published annually or semiannually.

Rating Stability & Transition Studies

Analyzes the consistency and evolution of KBRA’s credit ratings over time. These studies track upgrades, downgrades, affirmations, and withdrawals across sectors—helping market participants assess rating performance, transition trends, and long-term credit stability.

Conference Recaps

KBRA attends and participates in numerous industry conferences and events. Our recaps of these events are an industry must-read.

Loan Performance Trends

A monthly publication that highlights Conduit and SASB loan performance including delinquency trends, special servicing activity, and loan disposition/resolution activity.

Monthly CMBS Trend Watch

A monthly publication that highlights CRE securitization issuance trends, KBRA new issuance and surveillance rating activity, and KBRA research activity.

Loss Compendium

A semiannual publication that provides loss estimates—KBRA Lifetime Base Loss (KLBL) and KBRA Future Base Loss (KFBL)—for KBRA-rated conduit transactions.

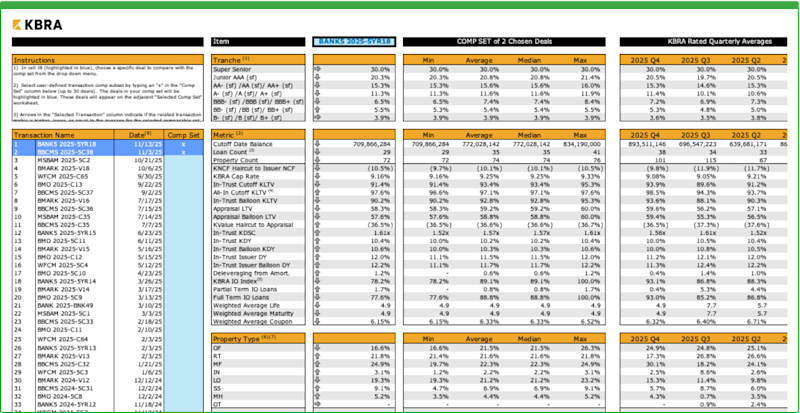

KBRA Comparative Analytic Tool (KCAT)

Excel-based interface providing loan-level and collateral characteristics, such as property types, LTV/KLTV, and MSA tiers

The database provides statistics on commercial mortgage collateral across Single Asset/Single Borrower (SASB), Conduit, and CRE CLO transactions

The tool produces comp tables from user selected deals to highlight key statistics across transactions with deals dating back to 2012

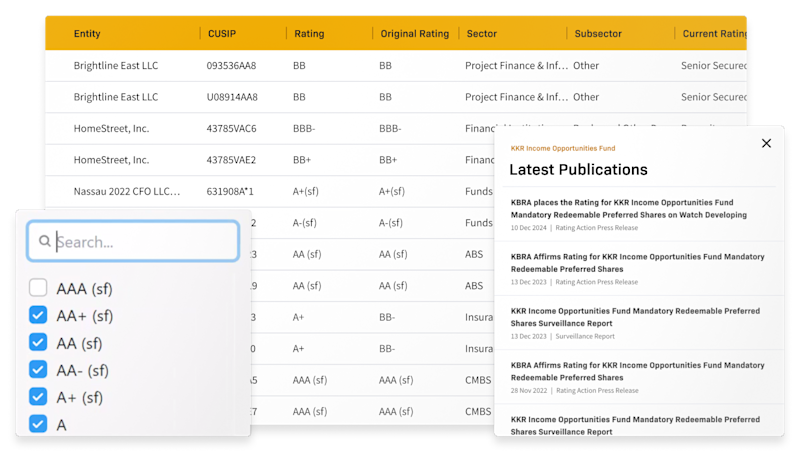

KBRA Portfolios

A centralized, intuitive dashboard for tracking KBRA credit ratings and analytics across your portfolio or sectors of coverage:

Upload your list of securities and issuers in seconds

Configure an Excel-style grid—toggle metrics, view ratings and structural features

Filter, sort, and slice across entity, sectors, or timeframes

Receive real-time notifications on your portfolio

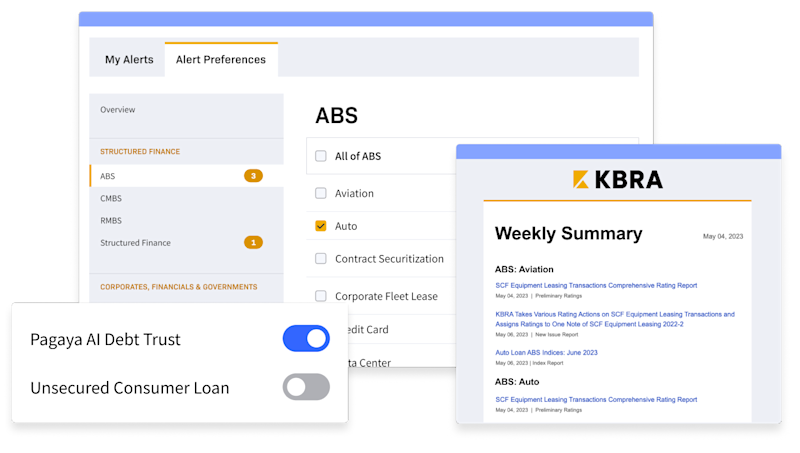

KBRA Alerts

Receive timely updates from your coverage areas so you don’t miss anything:

One-click subscriptions to ratings and research alerts

Custom filters and views across sectors and names

Alerts delivered via email and your notification dashboard

Request a Consultation (CMBS)

Ready to explore how KBRA Premium can bolster your credit insights and decisions? Whether you’d like a demo, pricing, or tailored support, our team is here to help.