RMBS Premium

The RMBS subscription covers non-prime credit, CRT, MSRs, HEIs, BTL loans, reverse mortgages, and more. The offering delivers forward-looking analytics and sector-specific intelligence, helping investors and issuers track performance trends, structural shifts, and risk drivers across the full spectrum of residential mortgage credit.

31,000+

Ratings Issued

1,000+

Deals Rated

1st Place Overall

RMBS Market Share

Rating Publications

KBRA delivers end-to-end RMBS insight through pre-sale and new issue reports, streamlined tear sheets, and continuous surveillance coverage

Pre-Sale/New Issue Reports

Our Pre-Sale and New Issue reports deliver forward-looking credit analysis that help market participants evaluate new transactions with confidence.

These reports provide in-depth insight into deal structure, collateral quality, and key credit considerations.

Surveillance Reports

Timely reviews to validate rating alignment with performance and evolving conditions.

Historical Ratings

Review affirmations, upgrades, downgrades, and withdrawals to derive performance context.

Coverage

KBRA Premium delivers deep, sector-specific insights across prime, non-prime, CRT, and HELOC/CES RMBS— empowering market participants to track emerging risks, benchmark performance, and make data-driven decisions.

Subsectors

Credit Risk Transfer

Home Equity

Non-Prime

Other/Esoteric

Prime

Seasoned

Single-Family Rental

Small Balance CMBS/RMBS

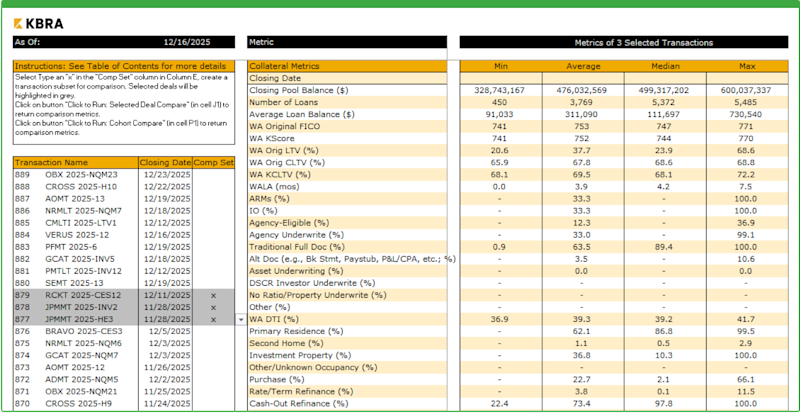

KBRA Comparative Analytic Tool (KCAT)

Excel-based interface built to provide statistics about residential mortgage collateral for many of the deals in the RMBS rated universe

Database provides loan-level borrower and collateral characteristics, such as credit quality, LTV, loan purpose, and geographic concentration

The tool produces comp tables using user selected deals to highlight key statistics across both KBRA-rated and non-KBRA transactions with deals dating back to 2010

Market Insights & Research

KBRA Premium provides actionable RMBS market intelligence, including default studies, borrower and credit trend analysis, conference takeaways, and performance insights from KBRA’s RMBS credit indices.

Monthly RMBS Credit Indices

KBRA’s RMBS Credit Indices deliver transparent, data-rich monitoring of delinquencies, modifications, prepayment activity, and other performance drivers across the key RMBS subsectors—from prime and non-prime to CRT and HELOC/CES.

Annual Sector Outlooks

Industry outlook, year in review, performance themes, trends, and forecasts generally published annually or semiannually.

Conference Recaps

KBRA attends and participates in numerous industry conferences and events. Our recaps of these events are an industry must-read.

Rating Stability & Transition Studies

Analyzes the consistency and evolution of KBRA’s credit ratings over time. These studies track upgrades, downgrades, affirmations, and withdrawals across sectors—helping market participants assess rating performance, transition trends, and long-term credit stability.

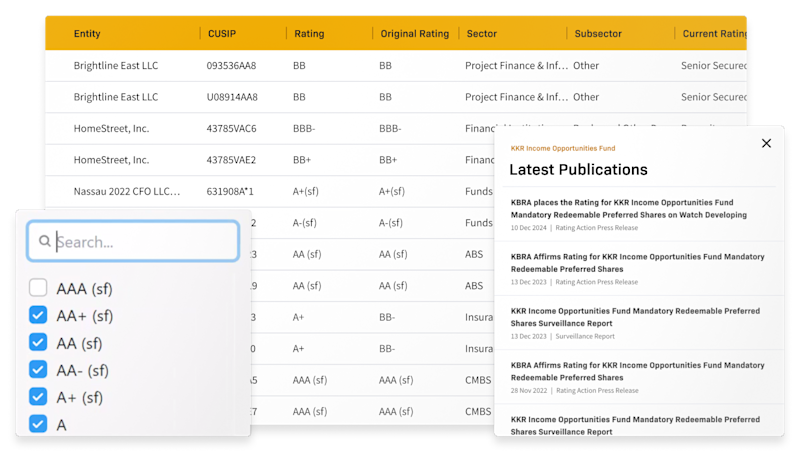

KBRA Portfolios

A centralized, intuitive dashboard for tracking KBRA credit ratings and analytics across your portfolio or sectors of coverage:

Upload your list of securities and issuers in seconds

Configure an Excel-style grid—toggle metrics, view ratings and structural features

Filter, sort, and slice across entity, sectors, or timeframes

Receive real-time notifications on your portfolio

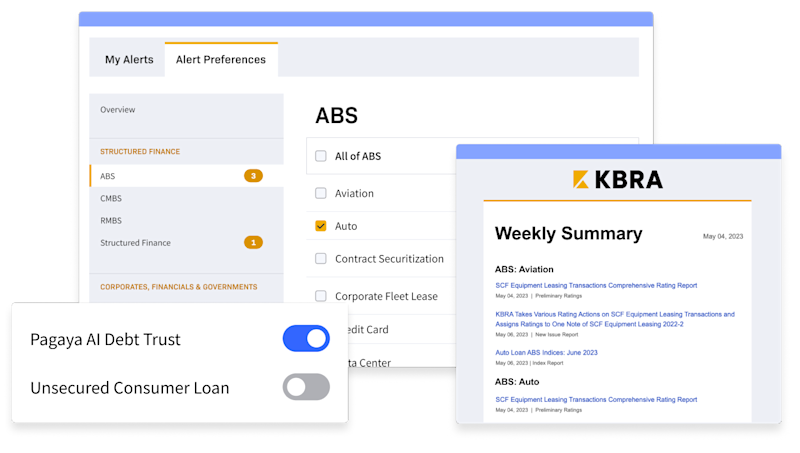

KBRA Alerts

Receive timely updates from your coverage areas so you don’t miss anything:

One-click subscriptions to ratings and research alerts

Custom filters and views across sectors and names

Alerts delivered via email and your notification dashboard

Request a Consultation (RMBS)

Ready to explore how KBRA Premium can bolster your credit insights and decisions? Whether you’d like a demo, pricing, or tailored support, our team is here to help.